can i get a mortgage if i owe back taxes canada

Front end ratio is a DTI calculation that includes all housing costs mortgage or rent private mortgage insurance HOA fees homeowners insurance property taxes etc As a rule of thumb lenders are looking for a front ratio of 28 percent or less. Now that you have your average monthly income you can use that to figure out your DTIs.

December 2018 Amanda Cassar As Financechicks Best Payday Loans Payday Loans Loans For Bad Credit

Public who owed the IRS in the previous year are good candidates to pay quarterly taxes too.

. If you file your return electronically through a NETFILE certified online tax preparation software you will not only receive an instant Notice of Assessment but youll also receive your refund in eight business days. Before getting a reverse mortgage you must first pay off and close any outstanding loans or lines of credit that are secured by your home. The longer you go without filing taxes the higher the penalties and potential prison term.

But in reality the IRS rarely digs deeper into your bank and financial accounts unless youre being audited or the IRS is collecting back taxes from you. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Well-to-do workers who owe money each year or those who simply.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Be informed and get ahead with. You can use the money you get from a reverse mortgage to do this.

If the current market value of your home wont cover the costs to sell it may not be the best time so do the math and weigh your options. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. You can use the remainder of the loan for anything you wish such as to.

I still get emails and comments all the time about it so I thought it was time for a bit of an update. Enter third-party payment processorsThese companies will let you use a credit card to pay almost any entity. How far back can you go to file taxes in Canada.

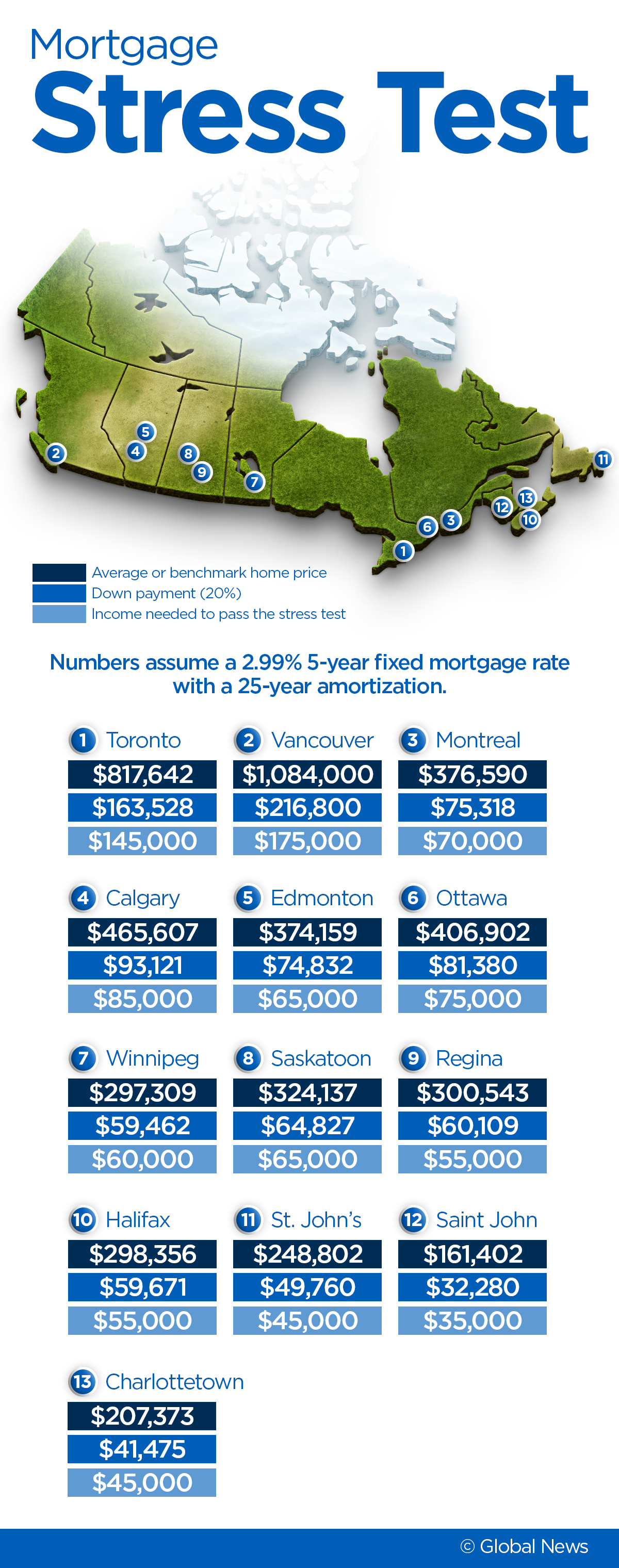

The best thing you can do is estimate the financial outcome ahead of time. Filing Your Taxes Online With Direct Deposit. New Mortgage Stress Test Rules June 2021.

My Experience with Self-Employed Taxes in Canada. The earlier you can get a good estimate on your potential profit or loss the more time you have to make a plan. The emotional strain of dealing with debt can be almost damaging as getting your electricity cut off or having your car repossessed or seeing your credit score plunge to where youll never get another loan.

As of June 1 2021 in order to pass the mortgage stress test youll need to qualify at your contracted mortgage interest rate plus 2 or 525 which is the benchmark rate or floor used to qualify uninsured and insured mortgagesFor example if you are applying for a mortgage at a rate of 365 then your lender. When I first wrote this blog post I had just finished my first year of self-employment. With housing alone a 2021 report by the Federal Reserve Bank of Philadelphia estimated that families owe about 11 billion in back rent.

If that happened the IRS would probably refund the extra payment but no right away necessarily. Your taxes are not due until May 17 this year so I suggest you wait until then to send a payment if the debit doesnt go through. This also means that John and Jane Q.

These can include a mortgage and a home equity line of credit HELOC. Fast-forward to 2021 and its still my most popular blog post. While the competitive landscape is always evolving the best-knownand seemingly.

Whether you are late by one year five years or even ten years it is crucial that you file. Filing online is arguably the fastest way to receive your income tax refund. You can pay the tax online or with a check but it may get debited again if you do that.

The IRS has loads of information on taxpayers. The IRS probably already knows about many of your financial accounts and the IRS can get information on how much is there. Known as a dependent care FSA parents can set aside as much as 5000 if filing a joint tax return 2500 for single filers that can be spent on qualifying dependent care expenses.

Reasons To Buy A New Home In Winter Video Tax Refund Home Buying New Homes

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Real Estate Rentals Rental Property Investment

Can Mortgage Be Deducted From Rental Income Debt Ca

5 Reasons You Should Buy A Home Right Now Home Buying Real Estate Infographic Real Estate Buying

Ehs Safety Portal In 2021 Health And Safety Messages Portal

Weather For Canada Swiss Quality Weather Forecasting Meteologix Com Weather Data Weather Satellite Temperature Weather

What Are Variable Fixed Open And Closed Mortgages Mortgage Mortgage Payoff Refinance Mortgage

How To Make Your Canadian Mortgage Interest Tax Deductible

Dakota Residents Have Biggest Federal Tax Bills Says Study Tax Debt Irs Taxes Irs

Mortgages Nextadvisor With Time Suze Orman Retirement Planning Retirement Planning Finance

Holidays In Selected Countries Notice The Uk Is Relatively Low On This List Although Some Typically Produ Holiday Pay Teaching Inspiration Best Pictures Ever

Pin By Jessica Hufford On Money Tax Checklist Tax Prep Checklist Tax Preparation

Motusbank Review Level Up Your Savings How To Save Money Personal Line Of Credit Level Up High Interest Savings

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

When You Draw Up Your Retirement Budget Don T Forget About Tax Expenses Or You Could End Up With Far Less Income Than You Tax Debt Irs Taxes Federal Taxes

How Do You Get Profits Out Of Your Business Payroll Salary Owner Draw Distribution Etc Guara Business Tax Business Podcasts Small Business Tax